Introduction to ABC .328 1.27

Are you looking to enhance your trading game? If so, the ABC .328 1.27 strategy might just be the tool you need in your arsenal. This innovative approach combines technical analysis with a clear structure, making it easier for traders of all levels to identify potential opportunities in the market. Whether you’re a seasoned pro or just starting out, understanding how to implement this strategy can lead to better trading results and increased profits. Ready to dive into the world of ABC .328 1.27? Let’s get started!

- Introduction to ABC .328 1.27

- Understanding the ABC .328 1.27 trading strategy

- Benefits of using this strategy

- Step-by-step guide to implementing the ABC .328 1.27 strategy

- Real-life examples of successful trades using this strategy

- Common mistakes to avoid when using this strategy

- Tips for maximizing profits with ABC .328 1.27

- Conclusion and final thoughts on utilizing this trading strategy

- FAQs

Understanding the ABC .328 1.27 trading strategy

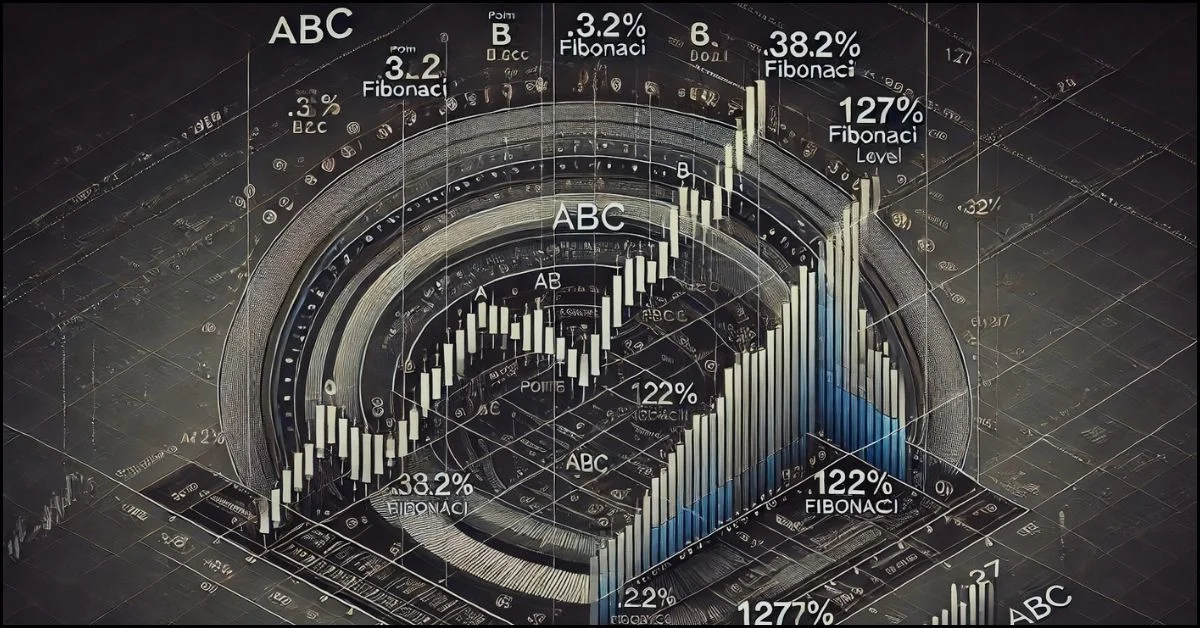

The ABC .328 1.27 trading strategy is a powerful tool for traders seeking to enhance their market analysis. At its core, this approach relies on Fibonacci retracement levels combined with price action patterns.

The “ABC” refers to three specific points in the market: A being the initial move, B representing a pullback, and C marking the next significant advance. The key lies in understanding how these movements interact with Fibonacci ratios.

The “.328” ratio indicates that traders look for retracements around 32.8% of the previous movement before considering entry points. Meanwhile, 1.27 signifies an extension target based on Fibonacci principles.

Utilizing this strategy requires keen observation and discipline as it revolves around identifying potential reversals and continuations within trends. Mastery of these concepts can lead to more informed trading decisions and improved outcomes over time.

Benefits of using this strategy

The ABC .328 1.27 trading strategy offers several compelling advantages for traders at any experience level.

First, it provides a structured approach to decision-making. This clarity helps traders avoid impulsive choices that often lead to losses.

Another benefit is its adaptability across various markets and assets. Whether you’re in forex or cryptocurrencies, this strategy can be tailored to fit different trading landscapes.

Moreover, the ABC .328 1.27 technique emphasizes risk management. By setting clear entry and exit points, traders can minimize potential losses while maximizing profits.

Many find that using this strategy enhances their confidence in trades. With a solid framework in place, you’re more likely to stick with your plan during volatile market conditions.

Step-by-step guide to implementing the ABC .328 1.27 strategy

To implement the ABC .328 1.27 strategy, start by identifying a suitable chart pattern. Look for an upward or downward trend that clearly forms points A, B, and C.

Once identified, measure the distance from point A to point B. This is vital as it helps establish potential price targets for your trades.

Next, apply the Fibonacci retracement tool at point B to determine the critical levels of support and resistance around 1.27%. These levels guide your entry and exit points.

Set your buy order slightly above this level to capitalize on any breakout momentum. Conversely, if you plan to short sell after confirming a reversal at these fib levels, ensure you’re prepared with stop-loss orders in place.

Monitor market conditions closely post-trade execution; adjustments may be necessary based on volatility or unexpected market shifts.

Real-life examples of successful trades using this strategy

Consider a trader who took advantage of the ABC .328 1.27 strategy in the forex market. They identified an upward trend on the EUR/USD pair, spotting an ABC pattern forming. The completion point at 1.27 provided a perfect entry for a long position.

Another example involves equities trading, where a trader noticed an ABC formation with Apple Inc.’s stock. After recognizing the potential move, they entered just below the .328 retracement level and saw significant gains as it hit their target near 1.27—proving that timing is everything in successful trades.

In cryptocurrency, one investor capitalized on Bitcoin’s price action by applying this methodology during its volatile swings. By strategically placing their trades around these key levels, they managed to secure impressive returns amidst the chaos of rapid price movements.

Common mistakes to avoid when using this strategy

One common mistake traders make is neglecting to fully understand the ABC .328 1.27 strategy before diving in. Rushing into trades without grasping the core principles can lead to costly errors.

Another pitfall is failing to implement proper risk management. Ignoring stop-loss orders or trading with too much leverage can amplify losses significantly.

Overtrading often occurs when traders stick rigidly to their strategy, even in unfavorable market conditions. Flexibility is key; sometimes it’s better to sit out rather than force a trade that doesn’t align with your criteria.

Many traders let emotions guide their decisions. Staying disciplined and adhering strictly to your analysis will help you avoid impulsive choices that derail potential profits.

Tips for maximizing profits with ABC .328 1.27

To maximize profits with the ABC .328 1.27 strategy, it’s essential to stick to your trading plan. Discipline is key. Avoid emotional decisions that can lead to unnecessary losses.

Utilize stop-loss orders effectively. This helps protect your capital during unfavorable market conditions and allows you to minimize risk while still following the strategy.

Another tip is to analyze market trends regularly. Keeping an eye on economic indicators and news events can provide insights that enhance your trade timing.

Always be ready for adjustments in your approach as new data emerges. Flexibility will enable you to capitalize on shifting trends without compromising your overall strategy.

Consider running a demo account before committing real funds. Practicing in a controlled environment builds confidence and hones skills needed for successful trading using ABC .328 1.27.

Conclusion and final thoughts on utilizing this trading strategy

Utilizing the ABC .328 1.27 trading strategy can truly transform your approach to the markets. By understanding its nuances, traders equip themselves with a powerful tool that enhances decision-making.

This method emphasizes precision and adaptability in various market conditions. As you become more familiar with it, you’ll notice how effectively it captures trends and reversals.

Embracing this strategy is not just about numbers; it’s about cultivating discipline and patience. These qualities are essential for anyone serious about improving their trading results.

Stay committed to learning and adapting as you gain experience. The ABC .328 1.27 isn’t merely a technique—it’s an evolving framework that supports your growth as a trader.

FAQs

Q: What is the ABC .328 1.27 trading strategy?

A: The ABC .328 1.27 strategy is a technical analysis approach that focuses on identifying price retracements and extensions, allowing traders to pinpoint potential entry and exit points effectively.

Q: How do I identify an ABC pattern?

A: An ABC pattern consists of three movements: A (the initial price movement), B (the retracement), and C (the extension). By analyzing these movements, traders can forecast future market behavior.

Q: Can anyone use the ABC .328 1.27 strategy?

A: Absolutely! This trading strategy can be employed by both beginners and experienced traders alike, provided they take time to understand its nuances.

Q: What markets can I apply the ABC .328 1.27 strategy to?

A: You can utilize this method across various markets including stocks, forex, commodities, or cryptocurrencies as long as you have access to reliable charting tools.

Q: Are there any specific indicators that work well with this strategy?

A: While the primary focus is on price action, many traders enhance their analysis using tools like Fibonacci retracement levels or moving averages for added confirmation.

Q: Is it possible to combine other strategies with the ABC .328 1.27 technique?

A: Yes! Many successful traders integrate multiple strategies for a more comprehensive view of market conditions while still leaning on the core principles of the ABC model.

Q: What should I do if my trades are not performing well using this strategy?

A: Review your trade setups carefully and ensure you’re following proper risk management techniques. Continuous learning through backtesting will also help improve your results over time.