Artificial Intelligence (AI) and automation are transforming how peer-to-peer (P2P) crypto exchange trading functions. Globally, more than $60 billion moved via P2P crypto platforms in 2023.

In addition, the total trading volume on all crypto exchanges surpassed $10 trillion in 2023, highlighting the scale of both centralized and decentralized activity. These numbers show that P2P crypto exchange trading has become a major component of the crypto ecosystem.

As automation handles repetitive tasks and AI delivers data-driven insights, traders gain more control and transparency, and platforms become faster and more efficient.

In this guide, we will look at the impact of AI and automation on P2P crypto exchange trading, as well as its risks and future outlook.

The Traditional P2P Crypto Exchange Model

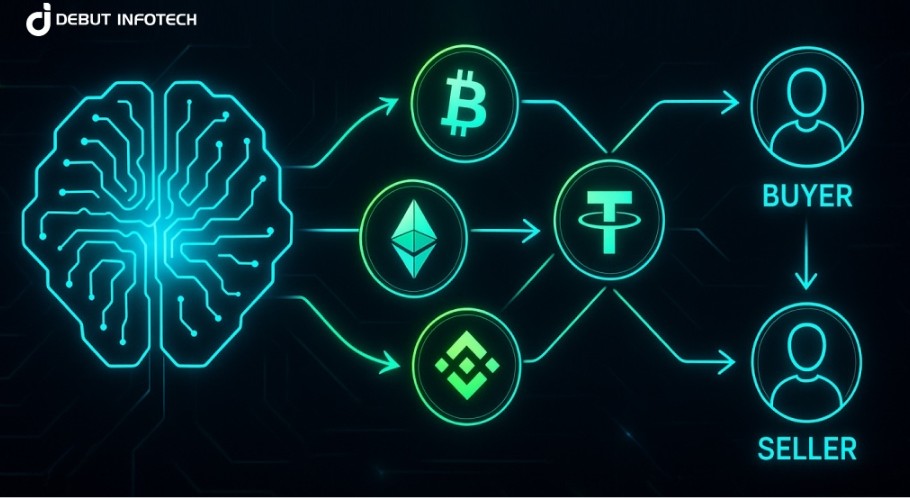

Traditional P2P exchanges serve as decentralized marketplaces where buyers and sellers interact directly without intermediaries. Transactions are often manual, depending on individual negotiation, order matching, and trust between users.

Escrow systems provide basic protection, but the lack of real-time automation and analytics limits scalability. Human-driven processes can delay transactions and make markets less responsive to sudden price changes.

As trading volumes grow and regulatory oversight tightens, these older models are struggling to meet the demand for precision, speed, and transparency that modern crypto markets expect.

Key Ways AI and Automation Are Transforming P2P Trading

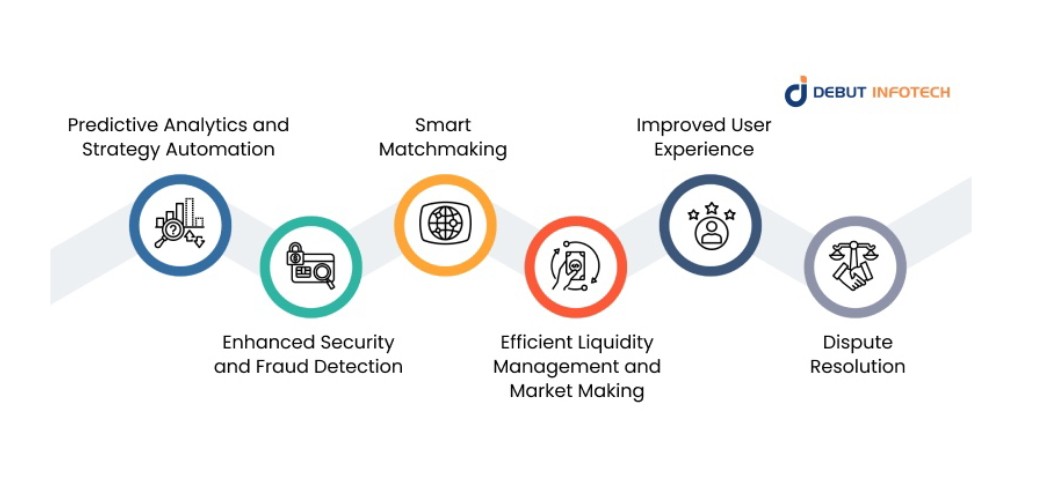

1. Predictive Analytics and Strategy Automation

AI-driven predictive models are helping traders identify market trends and automate trading strategies based on real-time analysis. Instead of relying on gut instinct, users can now execute trades automatically when specific conditions are met. These algorithms analyze massive datasets—price histories, blockchain data, and user behavior—to make timely predictions.

Automated systems reduce emotional bias and human error, giving both casual and professional traders a more disciplined trading framework. This combination of insight and automation makes P2P trading more efficient and less unpredictable.

2. Enhanced Security and Fraud Detection

Automation powered by AI has improved security in P2P crypto exchange platforms through behavior-based fraud detection. Advanced machine learning systems continuously monitor wallet addresses, trading activity, and transaction patterns to identify anomalies in real time.

Suspicious actions, such as multiple failed login attempts or irregular trading behaviour, can trigger automated alerts or instant account restrictions. These proactive systems help top decentralized exchanges detect and stop scams before they impact users. By integrating AI-driven verification tools, P2P platforms are reducing fraud rates and building stronger user confidence.

3. Smart Matchmaking

AI-powered matchmaking engines connect buyers and sellers faster and more accurately than manual methods. Instead of listing orders and waiting, traders are matched based on historical activity, price preferences, and location. This reduces waiting times and improves transaction success rates.

Over time, these systems learn user preferences, enabling more personalized recommendations and smoother trading experiences. Smart matchmaking makes P2P trading more dynamic, minimizing inefficiencies while promoting fairer pricing and stronger liquidity flow across platforms.

4. Efficient Liquidity Management and Market Making

AI and automation simplify liquidity management by monitoring market depth and executing trades that balance supply and demand. Automated market-making algorithms react to changes instantly, keeping spreads stable and ensuring smoother order execution. These systems also minimize slippage during high volatility, allowing exchanges to maintain consistent trading volumes.

For users, this translates into fewer interruptions, faster settlements, and a more stable market environment. Automation ensures that even smaller exchanges can maintain healthy liquidity without constant human oversight.

5. Improved User Experience

Automation enhances usability across P2P exchanges. AI chatbots, automated KYC tools, and predictive dashboards simplify onboarding and trade management.

Users can access real-time market insights, automate recurring trades, and receive instant support without waiting for human intervention. This creates an experience closer to centralized exchanges—fast, fluid, and intuitive—without compromising on decentralization.

As more white label crypto exchange platforms adopt these tools, P2P trading becomes accessible to broader audiences, helping expand crypto adoption globally.

6. Dispute Resolution

AI and exchange are streamlining dispute resolution in P2P trading by evaluating transaction records and communication logs faster than human moderators.

Automated resolution tools use sentiment analysis and contract verification to detect fraudulent claims or inconsistencies. This reduces waiting time and ensures fair outcomes backed by transparent data.

In turn, traders experience fewer conflicts and greater trust in platform governance. Automated dispute handling ensures both parties are treated fairly while maintaining the platform’s integrity and efficiency.

Risks and Challenges of AI and Automation on P2P Crypto Exchange Trading

1. Data Quality and Bias

AI models rely heavily on data accuracy on decentralized crypto exchange platforms. Poor-quality or biased datasets can produce flawed predictions, leading to unfair pricing or trade mismatches.

Exchanges must implement data verification frameworks and monitor algorithms to prevent these biases. Consistent auditing and transparency in data sourcing are key to maintaining fairness and reliability in automated decision-making.

2. Technical Failures

AI Automation increases operational speed but introduces risks tied to system errors or algorithmic trading bugs. A single malfunction can trigger a chain reaction, disrupting multiple trades or even affecting liquidity.

Exchanges need robust infrastructure, constant monitoring, and backup protocols to reduce downtime. As platforms grow more automated, system reliability becomes a defining factor in user trust.

3. Market Unpredictability

AI systems can forecast patterns but cannot eliminate market unpredictability. Sudden news, regulation changes, or macroeconomic shifts can still cause rapid volatility that even the best models can’t fully anticipate.

To manage this, traders should combine algorithmic insights with human oversight, ensuring decisions remain adaptable. This balance keeps automation from becoming overconfident or detached from real-world context.

4. Regulatory Uncertainty

As AI and automation reshape trading behavior, regulatory frameworks often lag behind. Some regions lack clear guidelines on algorithmic decision-making or automated market interventions.

Exchanges operating globally must navigate these inconsistencies carefully, adopting transparent AI practices that align with evolving compliance requirements. Clarity in regulation will be vital for sustainable innovation.

5. Over-Reliance

Depending too heavily on AI exchange automation can make traders complacent. Blind trust in algorithms removes human judgment from trading strategies, increasing vulnerability to black swan events.

The future of P2P trading will require a hybrid model where human insight complements machine precision. Automation should enhance—not replace—strategic thinking.

6. Ethical Concerns

As AI in crypto exchange takes on more decision-making, ethical transparency becomes crucial. Users must understand how algorithms evaluate data, assign priorities, and handle disputes. Hidden biases or opaque models can lead to unfair outcomes.

P2P exchanges adopting AI should commit to open-source validation, fair design, and accountability in automated processes to maintain user trust.

Future Prospects of AI and Automation on P2P Crypto Exchange Trading

1. Smarter Algorithms and Predictive Analytics

AI models will continue evolving, using larger datasets and self-learning mechanisms to anticipate market movements more accurately. P2P and OTC crypto exchange platforms that integrate adaptive algorithms can deliver faster, smarter trading experiences tailored to individual strategies. Predictive analytics will guide automated trading in near real time, making market reactions more precise and responsive.

2. Decentralized Finance (DeFi) Integration

AI-driven automation will play a stronger role in connecting P2P exchanges with DeFi protocols. Through smart contracts, users will gain access to cross-platform liquidity, staking opportunities, and yield strategies without intermediaries. Automated systems will ensure seamless interoperability, making decentralized trading ecosystems more efficient, secure, and inclusive.

3. Regulatory Adaptation

As AI becomes a core part of crypto markets, regulators will adapt frameworks that balance innovation with accountability. Transparent automation practices and verifiable data handling will become mandatory. Exchanges that prioritize compliance through explainable AI models will stay ahead of the curve, ensuring long-term stability and user trust in automated environments.

4. Improved Efficiency and Liquidity

AI and automation will make liquidity flow more predictable by optimizing trade execution and reducing slippage. Automated market makers and liquidity bots will synchronize activity across multiple platforms, minimizing friction. This evolution will allow P2P exchanges to compete with centralized markets in both speed and scale.

5. Advanced Risk Management

Future AI systems will integrate multi-layered risk assessment models capable of evaluating user credibility, market volatility, and liquidity exposure simultaneously. This predictive intelligence will help exchanges anticipate issues before they occur. By merging automation with transparency, future P2P trading will achieve stronger resilience against systemic shocks and user-level risks.

Conclusion

AI and automation are redefining P2P crypto trading from the ground up. By improving prediction accuracy, market stability, and trust, these technologies are setting a new standard for decentralized exchanges. Still, success depends on maintaining transparency, regulatory compliance, and ethical responsibility.

The next generation of P2P trading will thrive where automation and human oversight coexist—creating markets that are faster, safer, and more inclusive.

Debut Infotech is a top-rated p2p crypto exchange development company that helps businesses build future-ready P2P crypto exchanges powered by AI-driven automation. Our development team specializes in secure smart contracts, scalable architecture, and user-centric design.

With deep expertise in blockchain and DeFi integration, we deliver end-to-end solutions that align innovation with reliability—helping enterprises stay competitive in the evolving crypto market.

Our tailored approach ensures faster deployment, seamless automation, and long-term scalability, empowering clients to create efficient, trusted, and future-proof decentralized trading platforms.