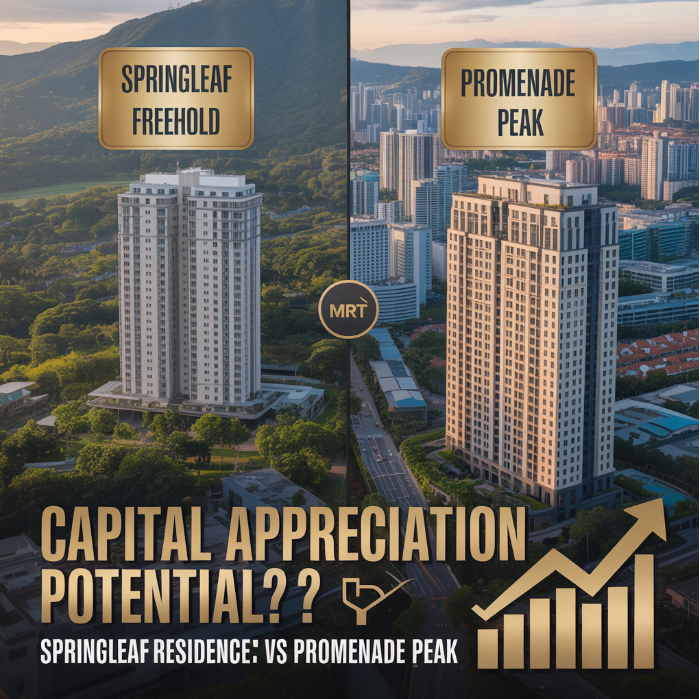

For many homebuyers and investors in Singapore, buying a condo isn’t just about having a comfortable place to live—it’s also about long-term value. In other words, capital appreciation. When you’re putting a substantial amount of money into a property, you want to be confident that its value will grow over time.

- Understanding Capital Appreciation

- Why Springleaf Residence Has Long-Term Value

- 1. Freehold Advantage

- 2. Low-Density, High Exclusivity

- 3. Thomson-East Coast Line (TEL) Appeal

- 4. Proximity to Nature & New Developments

- Promising Capital Gains at Promenade Peak

- 1. Prime City-Fringe Location

- 2. Excellent Rental Yield Supports Value

- 3. Connectivity Drives Price Growth

- 4. Nearby Redevelopments

- Capital Appreciation: A Side-by-Side Summary

- So, Which Condo Has Stronger Appreciation Potential?

- Final Thoughts

That’s why two names have stood out in the 2025 property spotlight: Springleaf Residence and Promenade Peak. Both are near MRT stations, offer attractive lifestyles, and are relatively affordable in today’s market. But which one is likely to give you a better return on your investment in the years to come?

Let’s explore both condos in detail and see which has stronger capital appreciation potential.

Understanding Capital Appreciation

Capital appreciation refers to the increase in the value of a property over time. It’s influenced by various factors including:

- Location and proximity to transport

- Tenure (freehold vs. leasehold)

- Supply and demand in the area

- Upcoming developments nearby

- Rarity and exclusivity of the project

- Market cycles and broader economic trends

Now, let’s look at how Springleaf Residence stands in terms of appreciation potential.

Why Springleaf Residence Has Long-Term Value

Nestled in a peaceful, nature-rich enclave near Springleaf MRT on the Thomson-East Coast Line, Springleaf Residence offers a rare combination of exclusivity, convenience, and most importantly—freehold ownership.

1. Freehold Advantage

In a market where 99-year leasehold properties dominate, freehold units are becoming scarce. This rarity alone gives Springleaf Residence an edge when it comes to capital growth. Buyers know they’re not limited by a ticking lease clock, and that boosts long-term appeal.

2. Low-Density, High Exclusivity

This boutique development has fewer units than typical mega-condos, which helps control future resale supply. As demand grows and supply remains limited, prices often rise more steadily and retain value better—especially when located near MRT access.

3. Thomson-East Coast Line (TEL) Appeal

TEL is an expanding MRT line with direct links to Orchard, Shenton Way, and eventually the East Coast. Properties along new MRT lines tend to see greater appreciation, especially in areas that were previously underserved by public transport—like Springleaf.

4. Proximity to Nature & New Developments

Being close to nature parks like Upper Seletar Reservoir and the Mandai eco-tourism hub makes the area appealing to families and lifestyle-conscious buyers. As Singapore continues developing the north with more green initiatives and transport links, Springleaf Residence stands to benefit.

Promising Capital Gains at Promenade Peak

On the other end of the spectrum is Promenade Peak, a city-fringe, 99-year leasehold condo near Aljunied MRT on the East-West Line. With modern amenities and high urban accessibility, it appeals to both homeowners and investors.

1. Prime City-Fringe Location

Capital appreciation often starts with location, and Promenade Peak scores big here. It’s near Paya Lebar, Bugis, and the CBD—areas that have seen strong growth and urban renewal. Proximity to established business districts means demand is likely to stay strong.

2. Excellent Rental Yield Supports Value

Leasehold condos often shine in their first 10–15 years, offering high rental yield and strong resale interest. Investors looking to flip or rent out will benefit from the continuous demand for housing near MRT lines and major work hubs.

3. Connectivity Drives Price Growth

Aljunied MRT sits on the East-West Line, Singapore’s backbone. Its location makes it convenient for both locals and expats, students and professionals. As infrastructure around Geylang and Kallang continues to evolve, prices in this area are expected to climb.

4. Nearby Redevelopments

The Urban Redevelopment Authority (URA) has earmarked several surrounding zones for rejuvenation. From lifestyle enhancements to better transport and new commercial hubs, these improvements can drive higher capital gains for properties like Promenade Peak in the medium term.

Capital Appreciation: A Side-by-Side Summary

| Factor | Springleaf Residence | Promenade Peak |

| Tenure | Freehold | 99-year leasehold |

| Location | Suburban (Upper Thomson) | City-fringe (Aljunied) |

| MRT Line | Thomson-East Coast Line | East-West Line |

| Entry Price | Moderate | Slightly Lower |

| Rarity | High | Moderate |

| Rental Demand | Moderate | High |

| Nearby Developments | Mandai eco-hub, nature parks | URA city-fringe redevelopment plans |

| Target Buyers | Long-term homeowners, families | Young professionals, investors |

So, Which Condo Has Stronger Appreciation Potential?

Springleaf Residence is likely to see slow but steady long-term appreciation, supported by its freehold tenure, low-density layout, and growing MRT connectivity. It’s ideal for buyers looking to hold their property over a long period and pass it down to future generations.

Promenade Peak, on the other hand, may enjoy faster short- to mid-term appreciation thanks to its central location, increasing demand, and surrounding redevelopments. It’s a stronger pick for those focused on capital gains within 5–15 years or planning to resell after rental returns.

Final Thoughts

Choosing between Springleaf Residence and Promenade Peak depends on your timeline and investment strategy. If you’re in it for the long haul and want freehold security, Springleaf Residence offers unmatched peace of mind with great upside potential.

If you’re eyeing quicker gains in a buzzing location, Promenade Peak presents exciting opportunities backed by solid demand and future growth.

Both are excellent choices under $2M—just matched to different goals. Either way, you’ll be buying into a smart property that has its own edge in Singapore’s evolving market.