Payroll management is a time-consuming and error-prone task as it involves compliance with complex tax laws and other regulations. That’s why outsourcing payroll services is becoming a popular trend among both large and small-scale businesses. It allows businesses to focus on core operations, reduce administrative burdens, and ensure accuracy in the payroll processes.

Though various national and international providers are offering a broad range of services, choosing local payroll providers in Atlanta can be a cost-effective and wise decision. The reason is that choosing a local provider ensures not only accurate payroll processing but also personalized services tailored to the challenges of operating in Atlanta.

Here are seven compelling reasons why Atlanta businesses should consider partnering with a local payroll service provider.

Local Expertise in Laws and Regulations

Being a business owner in Atlanta you are required to meet Georgia’s unique tax codes, labour laws, and compliance requirements, which can be challenging to navigate without proper expertise. Atlanta payroll services providers have an in-depth understanding of these regulations, ensuring your business stays compliant with state and local laws. They stay updated on changes in employment laws, such as minimum wage adjustments or new tax credits, and integrate these updates seamlessly into your payroll system. This localized knowledge minimizes the risk of penalties and ensures smooth operations.

Personalized Customer Support

Local payroll providers in Atlanta prioritize building strong relationships with their clients. Unlike national providers that rely heavily on automated support systems, local providers offer direct, personalized assistance. With a dedicated account manager who understands your business’s unique needs, you can address payroll issues quickly and efficiently. It not only helps streamline crucial operations but also provides aid in solving time-sensitive payroll issues such as discrepancies in employee pay or urgent compliance matters.

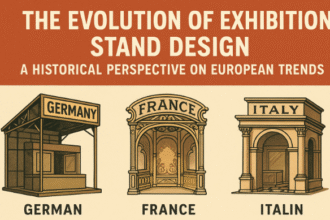

Tailored Solutions for Atlanta Businesses

Every city’s business market has its challenges and requirements, and Atlanta is no exception. A local payroll provider is equipped to understand the specific challenges faced by businesses in the area. Whether you’re a tech startup in Midtown, a restaurant in Buckhead, or a retail store in Decatur, local providers can customize their services to meet your needs. From flexible payment schedules to managing payroll for seasonal employees, they offer solutions that align with the demands of Atlanta’s diverse industries.

Networking and Community Engagement

Local payroll providers are often active participants in Atlanta’s business community. They sponsor events, host workshops, and engage in local networking groups, offering opportunities for you to connect with other businesses. These interactions can lead to valuable partnerships and insights into industry trends. Additionally, local providers understand the challenges of doing business in Atlanta, from cultural considerations to seasonal economic shifts, and they use this knowledge to help your business survive and thrive.

Enhanced Data Security

Data security is a critical concern for any business, especially when it comes to sensitive payroll information. Local providers often store data on secure servers within the region, reducing the risks associated with remote or overseas data centres. Additionally, they are familiar with Georgia’s data protection laws and ensure compliance with these regulations. With a local provider, you gain peace of mind knowing that your data is being handled responsibly and securely.

Cost-Effective Services

Local payroll providers often offer more competitive pricing compared to national corporations. They understand the budget constraints of small and medium-sized businesses and design their services accordingly. Without the overhead costs of large-scale operations, local providers can deliver high-quality services at a fraction of the cost. Their transparent pricing models ensure that you only pay for the services you need, avoiding unnecessary add-ons and hidden fees. Additionally, they are equipped with advanced technology and tools, providing you with free access to reliable payroll software like Netchex and time-tracking tools.

Flexibility and Agility

Another key advantage of a local provider is their ability to adapt quickly to your business’s changing needs. Whether you’re scaling up, downsizing, or dealing with seasonal workforce fluctuations, local providers can adjust their services to accommodate these shifts.

A Final Word

Outsourcing payroll services is an effective way to streamline operations, reduce administrative burdens, and ensure compliance with complex regulations. By partnering with a local provider, you can optimize your payroll processes without breaking the bank and also contribute to the growth of Atlanta’s vibrant business community.