Exporting goods comes with various costs, from import duties on raw materials to production expenses. To reduce this burden, governments offer incentives that help businesses stay competitive in global markets. One such incentive is duty drawback, which gives back some duties and taxes paid on imported materials used for exports. It helps businesses manage costs and supports international trade.

- What is Duty Drawback?

- How Does Duty Drawback Work?

- Benefits of Duty Drawback for Exporters

- 1. Performs Duty Drawbacks

- 2. Promotes More Exports

- 3. Relieves Dependence on Costly Inputs

- 4. Assists Investment in Business Growth

- 5. Provides a Government-Backed Advantage

- Duty Drawback vs. Other Export Incentives

- Conclusion

- FAQs

While duty drawback is a key benefit for exporters, it is not the only option. Various other export incentives exist, each with unique advantages and processes. Understanding what is duty drawback and how it compares to these alternatives can help businesses choose the best strategy to maximize savings and boost their global competitiveness.

What is Duty Drawback?

Duty Drawback is a government program that refunds certain duties and taxes paid on imported goods when those goods are later exported. This applies whether the imported materials are used in manufacturing or exported in the same condition. It helps businesses reduce extra costs on international trade.

This program supports exporters by making it easier to recover money spent on import duties. To qualify, businesses must follow specific rules, keep proper records, and file a claim with Customs. Since the process involves paperwork and approvals, many companies work with experts or customs brokers to ensure a smooth refund process.

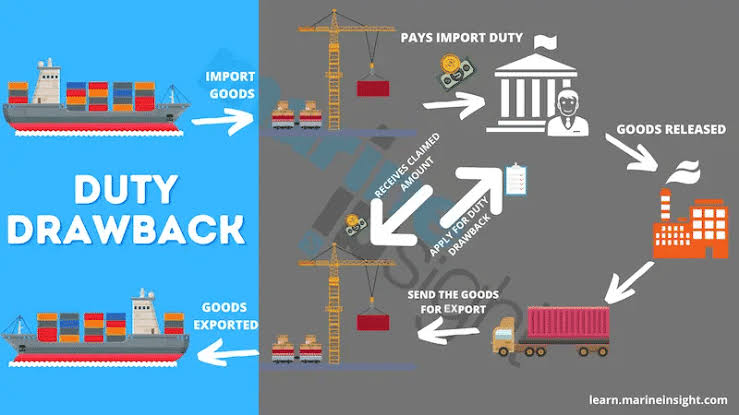

How Does Duty Drawback Work?

Duty Drawback allows businesses to get back certain duties and taxes paid on imported materials used for exports. To claim this benefit, exporters need to follow a specific process.

- Import and Use of Goods: Businesses import raw materials and pay duties and taxes at customs. These materials must be used in products meant for export.

- Export the Finished Product: The final goods made from imported materials must be shipped out of the country.

- Maintain Proper Documentation: Exporters must keep records proving the import and export of goods, including invoices, shipping documents, and duty payment receipts.

- File a Duty Drawback Claim: A claim must be submitted to Customs and Border Protection (CBP) or the relevant authority, following their guidelines.

- Processing and Refund: A refund is issued if the claim is approved. Businesses with Accelerated Payment Privilege (APP) can receive refunds faster.

By following these steps, exporters can recover costs and improve cash flow while expanding their trade operations.

Benefits of Duty Drawback for Exporters

Duty Drawback provides several advantages that help businesses reduce costs and improve global trade operations. Here are some key benefits exporters can gain from this incentive:

1. Performs Duty Drawbacks

Duty Drawback is vital because it allows exporters to recover the duty and tax paid on their imported materials, thus relieving financial pressure.

2. Promotes More Exports

This advantage promotes businesses with international expansion since the reduced cost enhances higher returns on exports.

3. Relieves Dependence on Costly Inputs

Duty Drawback helps the exporter by offsetting the expense of importation, making it cheaper to obtain quality materials.

4. Assists Investment in Business Growth

A major benefit of Duty Drawback is that it provides additional funds that can be reinvested into new technology, machinery, or staff.

5. Provides a Government-Backed Advantage

Since Duty Drawback is an official program, it benefits exporters by offering reliable financial support without risks.

Duty Drawback vs. Other Export Incentives

Exporters rely on various government incentives to cut costs and improve competitiveness worldwide. Duty Drawback is one of the most important programs, which refunds customs duties paid on imported materials used in exported goods. Other export incentives, including tax exemptions, subsidies, and duty-free import schemes, have different benefits but come with added conditions.

Key Differences:

Scope

Duty Drawback focuses only on refunding duties paid on imported materials used for exported goods. Other export incentives, such as tax exemptions, subsidies, and financial grants, provide broader financial relief beyond import duties.

Eligibility

To claim Duty Drawback, exporters must prove that the imported materials were directly used in manufacturing the exported goods. Other incentives may have different eligibility requirements, such as export volume, industry type, or value-added criteria.

Process

Duty Drawback directly refunds duties paid, making it a straightforward process. Other incentives, like duty-free import schemes or capital goods programs, often come with export obligations, compliance requirements, or investment conditions that must be met over time.

Flexibility

Compared with other incentives, Duty Drawback is more easily accessed since its core component of duty paid was mostly for claiming the duties. Other programs tend to have harder and more extended commitments or numerous papers that most companies may find rigid.

Conclusion

Duty Drawback is a key export incentive that helps businesses recover duties paid on imported materials used for exports. Reducing costs and improving cash flow allows exporters to stay competitive in global markets. Unlike other incentives with complex conditions, Duty Drawback offers a straightforward refund process, making it easier for businesses to manage expenses.

While other export incentives have different financial benefits, selecting the best option depends on business needs and trade strategies. For those looking to improve their cash flow, Drip Capital offers trade finance solutions that can help facilitate the smooth growth of international businesses.

FAQs

- Who is eligible for Duty Drawback?

Importers, manufacturers, and exporters who have paid duties on imported goods and later exported them can apply. Proper documentation and compliance with regulations are required.

- How long does it take to receive a Duty Drawback refund?

The time to receive a Duty Drawback refund depends on whether accelerated payment is approved. With approval, refunds take a few weeks; without it, the process can take a year or more.

- Can an exporter claim a duty drawback and other export incentives?

Yes, in some cases, exporters can combine duty drawback with other incentives, depending on each program’s regulations and eligibility criteria.