Mastering Exchange Rates with OnlineCheckWriter.com – Powered by Zil Money: A Smarter International Payment Solution

“You make a sandwich just the way you like it, but by the time you take a bite, half of it’s fallen apart—somehow, things went off track along the way.”

Similarly, when businesses send money across borders, choosing the right international payment solution is crucial because the process is heavily influenced by exchange rates—the value at which one currency converts into another. Just like the sandwich that didn’t quite hold up, a small fluctuation in exchange rates can cause unexpected costs, leading to a financial mess that businesses could have avoided with the right payment solution.

For example, as of today, 1 USD might buy 82 Indian Rupees (INR). But these rates aren’t static; they fluctuate continuously due to factors such as market demand, geopolitical events, inflation, and economic indicators. This constant movement in foreign exchange (FX) rates creates both opportunities and challenges for small and midsize businesses (SMBs) conducting international payments.

How Exchange Rates Work in International Payments

Exchange rates are determined by the foreign exchange market, where currencies are traded 24/7. The rates vary by the second depending on supply and demand, central bank policies, and global economic activity. When you initiate an international payment—say, from the US to India—the USD amount must be converted into INR upon settlement.

In an ideal world, the exchange rate you see when you send the money would be the rate applied to the recipient’s account. However, most traditional international payment systems use a process involving multiple banks and intermediaries, causing delays of several hours or days before the recipient receives the funds. During this time, exchange rates can shift, meaning the amount the recipient ultimately receives in local currency could be different—and often less—than originally anticipated.

The Challenges of Exchange Rate Volatility

This volatility introduces a core risk known as exchange rate risk or currency risk, which can have several adverse effects:

- Unpredictable Payment Amounts:The recipient may receive fewer funds than expected if the exchange rate moves unfavorably between initiation and settlement.

- Cash Flow Uncertainty:SMBs struggle to manage liquidity effectively when payments fluctuate unpredictably, complicating budgeting and forecasting.

- Increased Operational Work:Finance teams must spend extra time reconciling payments that don’t match invoices, leading to increased administrative costs and potential errors.

- Damaged Business Relationships:Underpayments or delays can erode trust with suppliers, contractors, and partners reliant on timely, accurate payments.

Exchange Rate Locking

To mitigate these risks, some financial instruments enable exchange rate locking—fixing the exchange rate at the time of payment initiation even if the funds settle days later. Rate locking guarantees the amount the recipient receives, providing predictability and protection against market fluctuations.

However, traditional banks and payment providers typically do not offer true rate locking for standard international wire transfers. Instead, the exchange rate is applied at settlement, leaving the customer exposed to currency volatility. Specialized products like forward contracts do offer rate locking, but these are generally complex, costly, and inaccessible to most SMBs.

Delays and Their Impact on Payments

Another major issue in legacy systems is settlement delay. Payments routed through correspondent banks and multiple intermediaries can take several days to complete. These delays not only increase exposure to exchange rate risk but also freeze working capital, limit cash flow flexibility, and generate uncertainty within finance operations.

Opaque fees from these intermediaries add a further layer of complexity, creating unpredictability in the total transaction cost. With unclear costs and delayed confirmations, SMBs face a tangled process that inhibits smooth financial management.

Common Risk Management Tools

Large enterprises typically hedge currency risk through forward contracts or currency options. However, these instruments are often too complex, costly, and inaccessible for SMBs with limited resources. Manual efforts to circumvent these risks through spreadsheets and constant transaction monitoring can drain internal teams and still fail to close the gap on delays and unpredictability.

Practical Solutions for SMBs

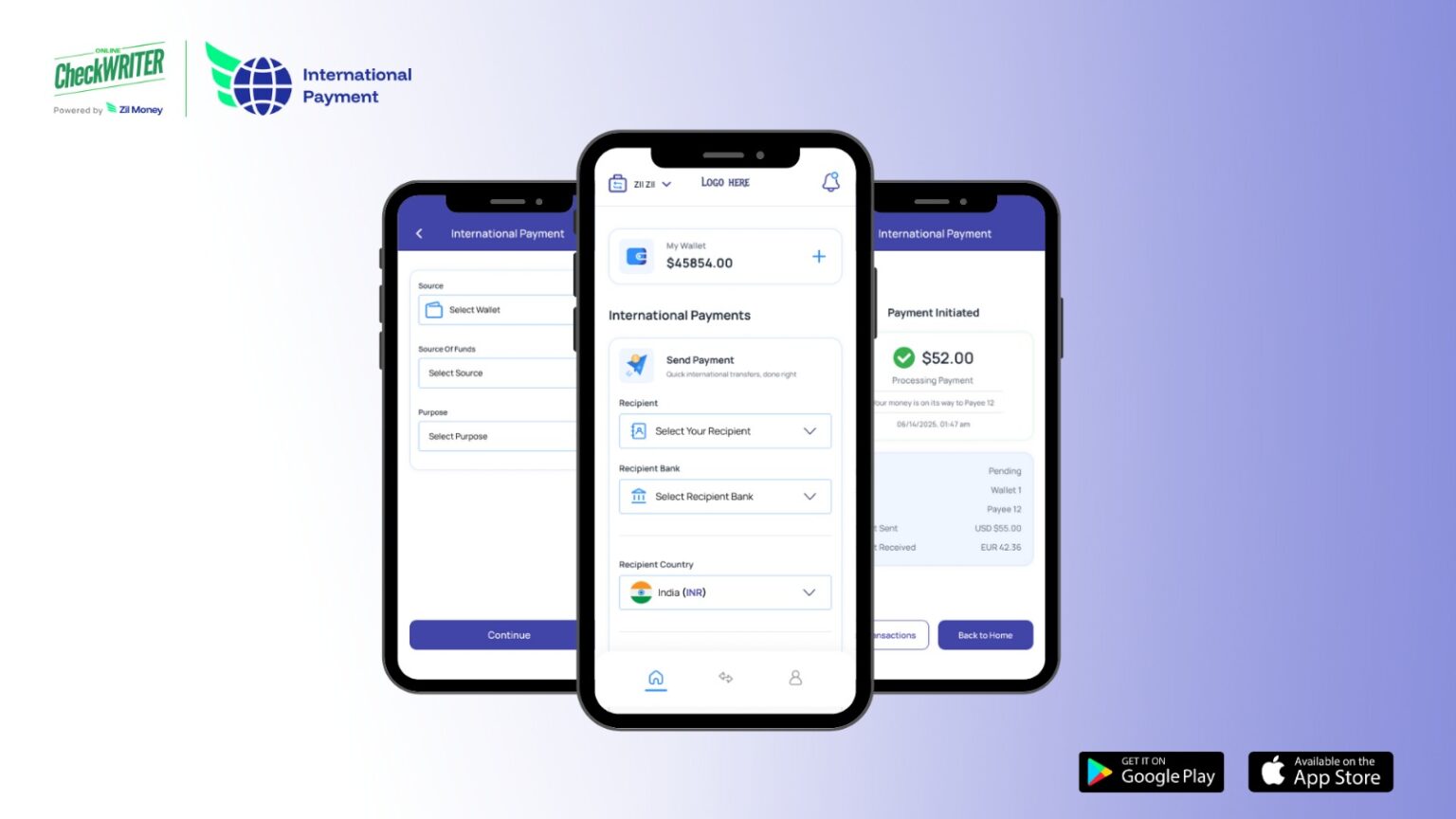

Emerging fintech platforms like OnlineCheckWriter.com – Powered by Zil Money have reimagined international payments for SMBs by combining technology and transparency to solve these fundamental problems:

- Live Exchange Rates:Advanced solutions offer upfront, guaranteed exchange rates during payment initiation, eliminating surprises and enabling precise budgeting.

- Fast vs. Instant Payments:By leveraging modern rails and partnerships, payments now settle within minutes instead of days, minimizing cash freeze periods.

- No Pre-Funding Requirements:Unlike traditional models demanding funds be held in foreign accounts, pay-on-demand models improve liquidity management.

- Comprehensive Security and Compliance:Incorporating enterprise-grade certifications (SOC 1, SOC 2, PCI DSS) and multi-layer encryption ensures payments meet regulatory requirements and guard against fraud.

- Full Multi-Currency Support and Transparency:Live market exchange rates with transparent fee disclosures empower SMBs to transact confidently in any supported currency.

Putting It All Together

The era of tolerating delayed, opaque, and uncertain international payments is ending. SMBs ready to scale globally deserve solutions built specifically for their unique challenges—balancing speed, transparency, security, and simplicity.

Leading-edge payment platforms like OnlineCheckWriter.com – Powered by Zil Money delivers instant transfers backed by real-time currency locking, clear pricing, robust compliance, and seamless integration with US banking and accounting systems. This combination empowers SMBs to act confidently, reduce inefficiencies, and unlock new growth opportunities.

FAQs

Q1: How does [Company Name] protect me from exchange rate fluctuations?

OnlineCheckWriter.com – Powered by Zil Money offers the best live exchange rates, which means the rate you see when you initiate the payment is the rate that will be applied. This protects you from currency volatility and ensures your recipients get the exact amount expected.

Q2: Do I need pre-fund for international payments?

No, OnlineCheckWriter.com – Powered by Zil Money does not require pre-funding. You only pay from your wallet, keeping your cash flexible and improving your working capital management.

Q3: How fast can payments be sent using the platform?

OnlineCheckWriter.com – Powered by Zil Money enables instant international payment transfers.